Debt payment formula

Long-term debt for a company would include any financing or leasing obligations that are to come due after a 12. Consider two scenarios with a monthly debt payment of 1500 each.

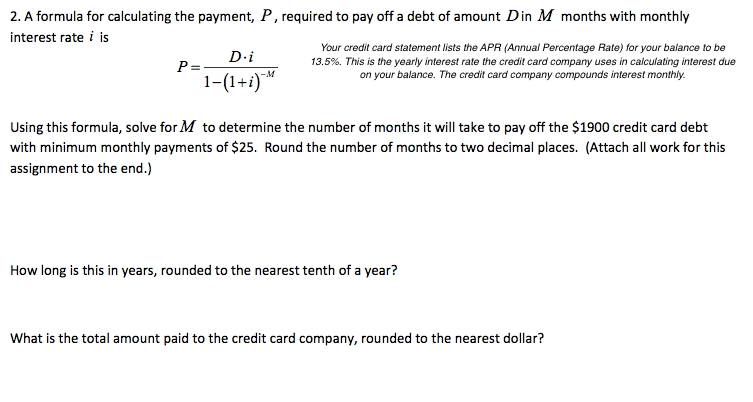

Solved 2 A Formula For Calculating The Payment P Required Chegg Com

200x and the debt service will be a much lower proportion of CFADS.

. A program of the Bureau of the Fiscal Service. Present value is linear in the amount of payments therefore the present. If this is the price of your house you must prepare a down payment of 66120.

They may even ask for the repayment of. Nper - The total number of payments for the loan. 3500 50000 7.

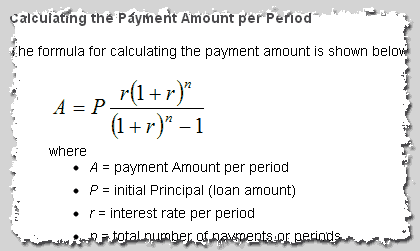

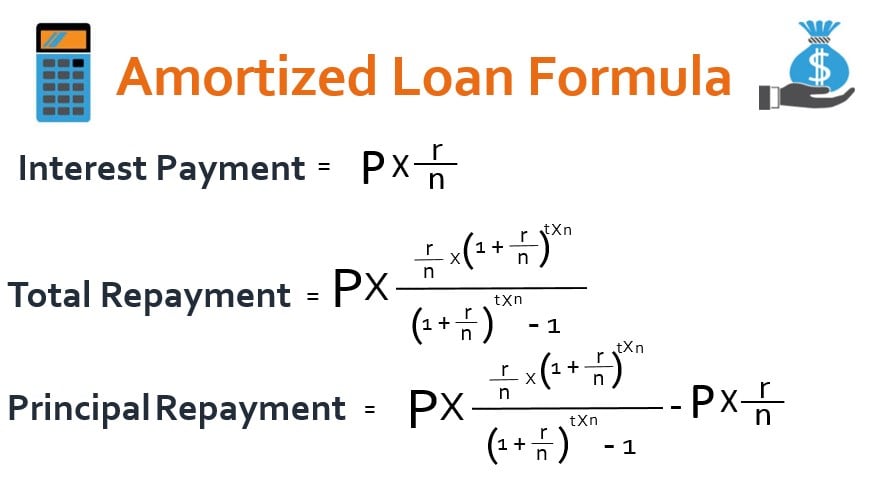

Where is the number of terms and is the per period interest rate. Monthly rent or house payment. The total monthly debt payment remains the same from month to month.

Pr360d P is the amount of principal or invoice amount. So the average payment period the company has been operating on is 84 days. As already explained in the example above the calculation of the net debt ratio is pretty simple.

Monthly alimony or child support payments. Type - optional When payments are due. To determine the debt ratio we will need to know the total liabilities debt and total assets.

If you only want to know how much youre paying in interest use the simple formula. Add up your monthly bills which may include. This is the formula the calculator uses to determine simple daily interest.

Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity. Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13. Debt Ratio Formula.

In projects with no demand risk eg. R is the Prompt Payment interest rate. To qualify for loan forgiveness you must make on-time payments for 20 years for loans disbursed after July 1.

An availability based hospital the debt service will comprise a large portion of CFADS during the debt tenor eg. Fv - optional The future value or a cash balance you want after the last payment is made. If the company fails to meet its Interest Payment continuously Lenders would worry about their capital.

0 end of period. It is defined by the equation Monthly Payment P r1rn1rn-1. D is the number of days for which interest is being calculated.

With 115x DSCR while in riskier endeavors like in mining the DSCR will be much greater eg. Debt-To-Income Ratio - DTI. Simple Cost of Debt.

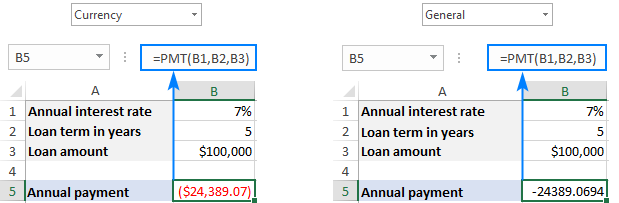

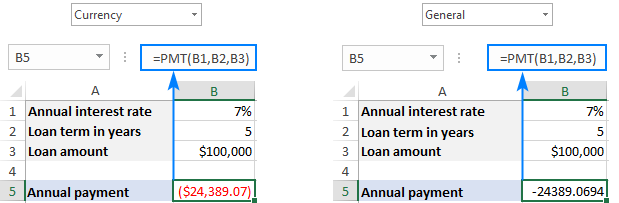

The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment EMI formula. The other methods listed also use EMI to calculate the monthly payment. Rate - The interest rate for the loan.

The debt-to-income ratio is one. 1 beginning of period. Student auto and other monthly loan payments.

These companies have a higher chance of continuing to meet their payment duty on time. Debt to Equity Ratio in Practice. Complex Cost of Debt.

The debt ratio can be expressed as either decimal or percentage. Total interest total debt cost of debt. If you have too much debt and too little income to pay off your student loans the Income-Based Repayment plan can help prevent default.

The management team will use this information to determine if paying off credit balances faster and receiving discounts might produce better results for the company. Meanwhile those who bought houses for the first time only made a 7 down payment. Formula for the Debt-to-Income Ratio.

Learn the equation to calculate your payment. This means that for every dollar. The formula to figure this is 200000 205000 2 so the average accounts payable is 202500.

Update 2172020 - Fixed the formula in the Google Sheets versions where the Months to Pay Off didnt work when the minimum payment is zero. Choosing a shorter-term loan 15 years instead of 30 years for example to speed up your debt repayment Shorter-term loans such as 15-year mortgages often have lower rates than 30-year loans. The IBR plan not only bases your payment on your income but also promises loan forgiveness.

Debt to Capital Ratio is a Solvency ratio that indicates how much of the companys capital is funded via Debt. Monthly Debt Payments refer to monthly bills such as rentmortgage car insurance health insurance credit cards. Credit card monthly payments use the.

The present value is given in actuarial notation by. These loans usually from an online lender credit union or bank provide a large amount of money to pay off multiple debts leaving you with one monthly debt payment. If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042.

Although you would have a bigger monthly payment with a 15-year mortgage you would spend less on interest. These values can be easily found on the balance sheet. Home Share via Facebook Share via Twitter Share via YouTube Share via Instagram Share via LinkedIn.

In practice however a 20 down payment is too hefty for most borrowers. The main issue arises in locating the figures from the financial statementsIt is easy to remember that the short-term debt will always be listed under the current liabilities liabilities or debts due in a year and the long-term debt would be listed under the. Pv - The present value or total value of all loan payments now.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Long-term debt consists of loans and financial obligations lasting over one year. The formula is Total Debt Total Capital.

The formula is Total Debt Total Capital. If youre paying a total of 3500 in interest across all your loans this year and your total debt is 50000 your simple cost of debt is 7. However the gross monthly income for scenario one is 3000 while the gross monthly income for scenario two is.

To calculate your debt-to-income ratio. As defined above the snowball is the difference between your total minimum payments and your total monthly debt payment. Defaults to 0 zero.

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Loan Payment Formula With Calculator

Annual Loan Payment Calculator Deals 53 Off Www Ingeniovirtual Com

Loan Payment Calculator With Interest Top Sellers 58 Off Www Ingeniovirtual Com

Time To Pay Formula Youtube

How To Calculate A Debt Constant Double Entry Bookkeeping

Excel Pmt Function With Formula Examples

Remaining Loan Balance Formula Car Loan Youtube

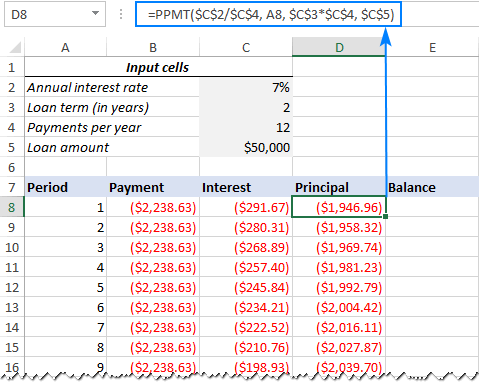

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

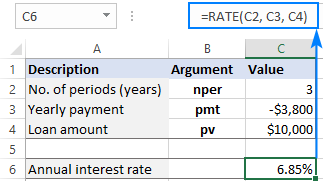

Using Rate Function In Excel To Calculate Interest Rate

Excel Formula Estimate Mortgage Payment Exceljet

Mortgage Calculator How Much Monthly Payments Will Cost

Excel Pmt Function With Formula Examples

Solve For Remaining Balance Formula With Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Payment On A Balloon Loan Formula With Calculator

Simple Loan Calculator

Excel Formula Calculate Payment For A Loan Exceljet